Limited Liability Partnerships (LLPs) have become a popular choice for entrepreneurs and professionals in India. While LLPs enjoy operational flexibility, they must also comply with statutory requirements—one of the most important being the LLP audit, especially if the annual turnover exceeds ₹40 lakhs or if the contribution exceeds ₹25 lakhs.

Whether you’re managing an established LLP or starting one, it’s essential to understand what documents and records are required during an audit. A proper checklist ensures that your audit process is smooth, timely, and compliant with the rules laid down by the Ministry of Corporate Affairs (MCA).

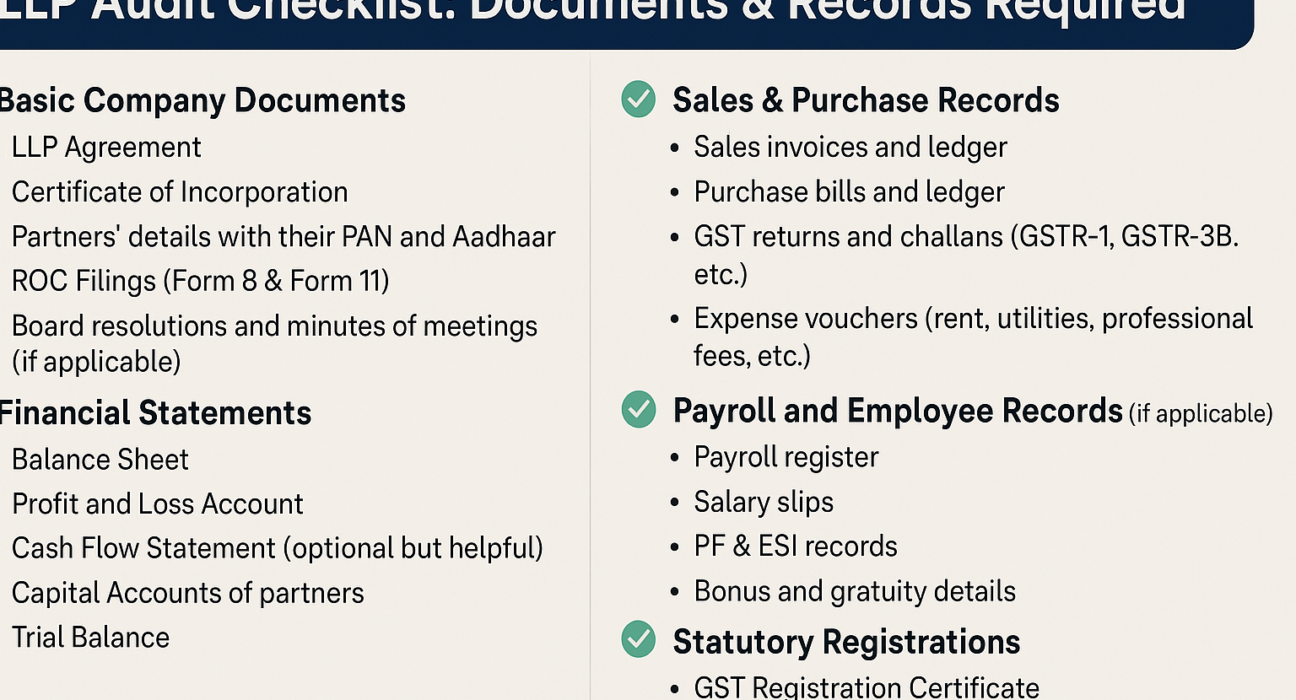

If you’re availing a LLP Audit Service in Delhi, here’s a helpful checklist of documents and records you’ll typically need to submit:

Basic Company Documents

These are foundational records that establish your LLP’s identity and structure:

-

LLP Agreement

-

Certificate of Incorporation

-

Partners’ details with their PAN and Aadhaar

-

ROC Filings (Form 8 & Form 11)

-

Board resolutions and minutes of meetings (if applicable)

Financial Statements

The auditor needs detailed insight into your financial activities to ensure transparency and accuracy:

-

Balance Sheet

-

Profit and Loss Account

-

Cash Flow Statement (optional but helpful)

-

Capital Accounts of partners

-

Trial Balance

Bank & Cash Records

Banking transactions play a critical role in verifying financial statements:

-

Bank statements of all LLP accounts

-

Bank reconciliation statements

-

Cash book and petty cash vouchers

-

Fixed deposit receipts and interest details

Sales & Purchase Records

Your revenue and expense data are essential for checking income accuracy and tax compliance:

-

Sales invoices and ledger

-

Purchase bills and ledger

-

GST returns and challans (GSTR-1, GSTR-3B, etc.)

-

Expense vouchers (rent, utilities, professional fees, etc.)

Taxation Documents

To verify compliance with income tax and other relevant laws, ensure these are in place:

-

Income Tax Return (ITR)

-

TDS returns (Form 24Q, 26Q, etc.)

-

TDS certificates (Form 16A)

-

Advance tax challans (if paid)

Payroll and Employee Records (if applicable)

If your LLP employs staff, maintain records for salary disbursement and compliance:

-

Payroll register

-

Salary slips

-

PF & ESI records

-

Bonus and gratuity details

Statutory Registrations

Auditors may also verify other statutory registrations that your LLP holds:

-

GST Registration Certificate

-

PAN & TAN

-

MSME/Udyam Registration (if applicable)

Why This Matters

Having these documents organized and ready can speed up the audit process and reduce the chances of errors or notices from authorities. If you’re not sure how to maintain or compile these records, it’s wise to consult a professional.

Choosing a reputed CA Firm in Delhi NCR can make a huge difference. Their expertise ensures that your LLP complies with the latest regulations and avoids penalties. Whether it’s a routine audit or a complex compliance matter, a trusted LLP Audit Service in Delhi can help you navigate everything smoothly.

Final Thoughts

LLP audits are more than just a regulatory formality—they’re a reflection of your business’s financial health and integrity. Keeping your documents ready, updated, and organized will help ensure you stay compliant and audit-ready at all times.

If you’re looking for professional support, consider hiring an experienced CA Firm in Delhi NCR that specializes in LLP Audit Service in Delhi. A smooth audit today can save you from major compliance issues tomorrow!